From: Spandan Joshi <joshispandan@yahoo.co.uk>

Date: 30 Nov 2009 04:36

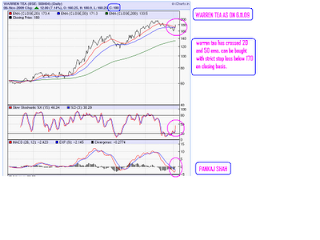

Subject: Mirage 1.3

| Dear all,

Mirage Version 1.3 ==================== 29/11/2009 ================

Where are we? =============== I firmly believe that we have completed B-C-4 (Downfall)

This lasted for 2 weeks and taken us to 15330, a fall of 2163 points from 17493.

The fifth wave has two targets

123% and 162%

They come to 17990 and 18834

Previously, under very first presentation of Mirage, I gave rough target of 17493 to 18115. However precise targets can only be given when wave gets completed.

Indeed this is my main scenario.

As per our main scenario, we may have completed B-C-5-2

5th wave is an up move as we have moved up from 15330 to 17200, already 1870 points.

This was probably the first wave called 5-1. The second wave has retraced 980 points to 16219. That is a 52% downfall to the 1st wave. With that I feel 2nd wave may be over by now, unless we break 16219 again. We may see 5-3 firing in upward direction. If that is a right direction and a count (Primary count) then we shall see 17806 as a 162% up move to the fall of 980 points.

The target comes to 17806 as per B-C-5-3 ================================== =============================================== However there are still small chances of Rally terminating below 17200. That will be our secondary scenario. For that to happen two conditions must be fulfilled.

1 We mustn't close above 17200 decisively. 2 We must break 16219 first followed by 15330 next.

Unless that happens, primary wave count should be followed by our model. If the above happens, one may consider as a 5th wave failure.

Strategy? =========== Not to trade/Buy can be a good idea. Watch it out for above findings. Of course over 17200 and 17493, one may prefer to buy only for ST trade. Sporadic buying opportunities can be picked up as and when in the mean time.

Wish you all a good luck.

Regards

Spandan Joshi |