Friday, April 30, 2010

STOCK TO WATCH : KAMANWALA HOUSING

Saturday, April 17, 2010

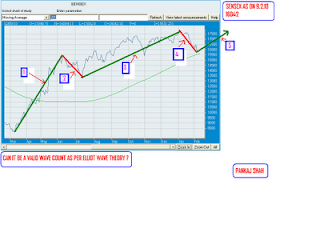

MARKET

Friday, April 16, 2010

astro predictions by BEJAN DARUWALA

Bejan Daruwalla needs no introduction. He is the world's most famous astrologer today and appears regularly on TV shows around the world. He is also a best-selling author and columnist. Currently his articles are published in The Sunday Times of India (Mumbai, Kolkata, Delhi and Chennai), Telegraph (Kolkata), Navhind Times (Goa), Dell Annual Horoscope 1998 (New York), News India (New York) and Berkley Communications (London). While, senior astrologer Dharmesh Joshi believes every problem has a solution. He possesses an excellent understanding of real life issues and its dynamics which he successfully addresses in the solutions he provides. His knowledge of Indian scriptures enables him to provide precise astrological remedies. Commodity markets and astro remedies are his areas of expertise.Dharmesh Joshi speaks to Beyond Market on behalf of Bejan Daruwalla for GaneshaSpeaks.com on the global economy, the current financial year, the best performing sectors among others.

bejan and joshi

Q. Do the stars suggest that the global economy is out

of recession?

The global economy is not completely out of recession. The recession started in January 2008 and now we can safely say that the worst is over. However, the recovery will still take a long time and there are a few patches of turbulence before the economy recovers fully. I presume that the world economy will be out of the blues by 2011.

Q. What does the current financial year look like?

There will be a correction around the second half of October '09 after which the market will be somewhat a float. I foresee a correction once again in the second and third week of January '10 (around the period of Makar Shankaranti) and the markets position will be very crucial during the first half of April '10. During the first 20 days of May '10 the market breadth will be negative wherein the market will seem healthy. However, these may be false sentiments. The market will show a negative trend during the last quarter of 2010 creating panic among investors. In short, if we are to summarize:

After 17th Oct '09: Correction

5th Jan '10 to 21st Jan '10: Correction

2nd Apr '10 to 16th Apr '10: Very Crucial

2nd May '10 to 19th May '10: Market breadth negative

30th Sept '10 to 1st Nov '10: Negative trend

7th Dec '10 to 31st Dec '10: Panic among investors

Q. What is the maximum level you see the Sensex and Nifty touching this financial year?

Sensex is expected to touch a maximum level of 18,500 and a minimum level of 13,200, while the Nifty is likely to touch a maximum level of 5,500 and a minimum level of 3,900.

Q. Where do you see the indices five years from now?

Sensex will touch the 50,000 mark in the next five years.

Q. Which sectors according to you would be among the best performers?

I feel pharmaceutical, energy, banking, FMCG and media will be the best performing sectors.

Q. What is your take on sectors like realty and retail that have taken a beating?

Mars, the karaka planet for realty was in Gemini till 5th October, which is an inimical house and then transits to Cancer on 6th October, which is its fall sign. Similarly Venus, the karaka planet for retail is in Leo till 10th October 2009 which is its inimical house after which it will transit to Virgo, which is its fall sign. Hence, these two sectors have been afflicted and are bound to remain so in the next year.

Q. Since equity markets are improving do you think the commodity markets will maintain their upward trend?

Yes, I certainly feel that the commodity markets will maintain the upward trend.

Q. What is the future of gold and crude oil?

The future of gold is bright and the range that I foresee would be between Rs 14,500 and Rs 17,500 per 10 grams while crude will be highly fluctuating but range-bound. Both will bear good returns over long-range investments.

Q. Do you see India as a super power among global economies?

No. I don't see India as a super power among global economies.

GaneshaSpeaks was founded in 2003 by Hemang Arun Pandeet and has steadily grown to be one of the most favoured destinations for astrological guidance using Indian vedic astrology principles. GaneshaSpeaks is a brand owned by SiddhiVinayak Astrology Services Pvt Ltd. GaneshaSpeaks involves Shree Bejan Daruwalla's principles of astrology in delivering personalized experience to each of its customers. The GaneshaSpeaks team consists of young, dynamic and raring-to-go individuals who strive for excellence in all areas of work.

Thursday, April 15, 2010

BAJAJ HIND GOOD ABOVE 141 FOR SHORT TERM

Tuesday, April 13, 2010

Friday, April 9, 2010

BUY HIND UNI LEVER AT 221

Thursday, April 8, 2010

INVERSE HEAD N SHOULDER BREAK OUT IN GOLD

************************************************************

UPDATE AS ON 12.05.10

GOLD TESTED TODAY 1244 DOLLAR.

TARGET ACHIEVED. PART PROFIT BOOKING IS ADVISED

Tuesday, April 6, 2010

RPOWER INVERSE HEAD N SHOULDER

CHART ATTACHED.

**************************************************************************************************