Thursday, December 31, 2009

Wednesday, December 30, 2009

STOP LOSS AT 16578

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhMJJuUs4OfFOx_Nm5XOYtIfcZdvpnM6qOoHpD9sV5MSrxxQsMnQD21Y0HzgUhwfiYk8hBBfQuZEivSjLSEuz3JLnXA3K6M5TNd9RaJNKuUXGdd9j3sp9U3ZbFMUNasJpBgIy52TacLx2A3/s1600-h/1-2-3+PATTERN-700450.PNG

NOW WE HAVE SEEN HIGHER BOTTOM AT 16578 ON 21/12/2009.

TODAY WE HAVE SEEN LOWER HIGH AND LOWER LOW AFTER GOOD RUN UP FROM 16578 TO 17486.

SO I REVISE STOP LOSS AT 16578 NOW.

POWER STOCKS SHOWING POWER

Friday, December 25, 2009

Tuesday, December 22, 2009

TRENDLINES

*********************************************

UPDATE AS ON 23.12.09

CHEERS! MARKET FOLLOWS BLUE PATH NOT RED!

ZANDU PHARMA

Scrip Code:506720 Company:Zandu Pharmaceutical Works Ltd

09 December 2009

Subject: Zandu Pharmaceutical fixes Book Closure for Scheme of Arrangement & AGM

Announcement: Zandu Pharmaceutical Works Ltd has informed BSE that the Register of Members & Share Transfer Books of the Company will remain closed from December 24, 2009 to December 31, 2009 (both days inclusive) for the purpose of:

1. As per Scheme of Arrangement, Emami Ltd. shall issue fourteen (14) equity shares of face value of Rs. 2/- per share of Emami Ltd. for every one (1) equity share of face

value of Rs. 100/- each held in the Company.

2. Annual General Meeting (AGM) of the Company to be held on December 31, 2009.

: Article sourced from: Lasting Legacies (Tata Review- Special Commemorative Issue 2004

|

Thursday, December 17, 2009

Wednesday, December 16, 2009

change in timing nse

****************************************************

UPDATE AS ON 17.12.09

Based on the market feedback, it has been jointly decided by NSE & BSE that the revision of market open timing to 9 am shall be effective from January 4, 2010. In the interim, the current market open timing of 9.55 am shall continue.

December 17, 2009

5 day chart as on 16.12.09

*****************************

UPDATE AS ON 17.12.09 4.30 PM

STILL WE ARE STUCK IN DOWNWARD CHANNEL.

COMMENTS BY SANDIP SABHARWAL ON US DOLLAR INDEX

http://www.sandipsabharwal.com/2009/12/is-us-dollar-index-bounce-back-enough.html

Tuesday, December 15, 2009

CHANGE IN TIMING FOR BSE EXCHANGE

Tuesday, 15th December, 2009

To: All Members of the Exchange

Sub: Change in Trading timings – Equity and Equity Derivatives segments

Trading Members of the exchange are hereby informed that pursuant to SEBI circular SEBI/DNPD/Cir-47/2009 dated October 23, 2009, with effect from Friday, December 18, 2009, trading in the Equity and Equity Derivatives segments will commence from 9.45 a.m. onwards, instead of the present timing of 9.55 am onwards.

Consequently, the continuous trading session in both segments will be from 9.45 a.m. to 3.30 pm on all business days. There will be no change in timings of any other session in both the segments.

It is however, clarified that the Block Deal window timings in the Equity Segment of the exchange will remain the same as stipulated by SEBI vide its Circular MRD/DoP/SE/Cir - 19/05 dated September 2, 2005 i.e. from 9.55 a.m. to 10.30 a.m. as at present.

In case trading members require any clarifications, they may please contact their respective Relationship Managers.

Mr. Dilip Oak

General Manager – I.T.

Friday, December 11, 2009

sensex view

*******************************************

UPDATE AS ON 16.12.09 10.52 AM

WE R VERY CLOSE TO LOWER TRENDLINE OF TRIANGLE WHICH IS A FIRST SUPPORT AREA.

MORE OVER 50% OF LAST RISE FROM 16210 TO 17361 IS 16786. SIMILAR SUPPORT IN NIFTY IS ARND 4995.

Thursday, December 10, 2009

MOSER BAER

**********************************

UPDATE AS ON 15.12.09 4.50 P.M.

STOP LOSS OF MOSER BEAR IS TRIGGERED TODAY. WE HAVE CLOSED BELOW 83

Wednesday, December 9, 2009

Long term technicals - Turning extremely positive: SANDIP SABHARWAL

HAVE A LOOK AT IT.

http://www.sandipsabharwal.com/2009/12/long-term-technicals-turning-extremely.html

Saturday, December 5, 2009

1-2-3 PATTERN

Thursday, December 3, 2009

Wednesday, December 2, 2009

TRADING SYSTEM

I HAVE FOUND A SIMILAR PATTERN . LINK IS GIVEN BELOW.READ IT AND TRY TO IMPLEMENT.

http://techtraderreport.com/Articles/CountBack/GuppyCountBack.html

Tuesday, December 1, 2009

BUYING LIST

ON CROSSING DOWNWARD CHANNEL MARKET MOVED UP IN VERY STRONG MANNER.

I LIST HERE FEW STOCKS WHICH R LOOKING STRONG TECHNICALLY.VERIFY AT YOUR END BEFORE BUYING.

CHENNAI PETRO ABOVE 222

TATA CHEM 294

CASTROL 540

IOC 301

KEEP STOP LOSS AS PER YOUR COMFORT

Monday, November 30, 2009

VIEWS OF SPANDAN JOSHI Mirage 1.3

From: Spandan Joshi <joshispandan@yahoo.co.uk>

Date: 30 Nov 2009 04:36

Subject: Mirage 1.3

| Dear all,

Mirage Version 1.3 ==================== 29/11/2009 ================

Where are we? =============== I firmly believe that we have completed B-C-4 (Downfall)

This lasted for 2 weeks and taken us to 15330, a fall of 2163 points from 17493.

The fifth wave has two targets

123% and 162%

They come to 17990 and 18834

Previously, under very first presentation of Mirage, I gave rough target of 17493 to 18115. However precise targets can only be given when wave gets completed.

Indeed this is my main scenario.

As per our main scenario, we may have completed B-C-5-2

5th wave is an up move as we have moved up from 15330 to 17200, already 1870 points.

This was probably the first wave called 5-1. The second wave has retraced 980 points to 16219. That is a 52% downfall to the 1st wave. With that I feel 2nd wave may be over by now, unless we break 16219 again. We may see 5-3 firing in upward direction. If that is a right direction and a count (Primary count) then we shall see 17806 as a 162% up move to the fall of 980 points.

The target comes to 17806 as per B-C-5-3 ================================== =============================================== However there are still small chances of Rally terminating below 17200. That will be our secondary scenario. For that to happen two conditions must be fulfilled.

1 We mustn't close above 17200 decisively. 2 We must break 16219 first followed by 15330 next.

Unless that happens, primary wave count should be followed by our model. If the above happens, one may consider as a 5th wave failure.

Strategy? =========== Not to trade/Buy can be a good idea. Watch it out for above findings. Of course over 17200 and 17493, one may prefer to buy only for ST trade. Sporadic buying opportunities can be picked up as and when in the mean time.

Wish you all a good luck.

Regards

Spandan Joshi |

Saturday, November 28, 2009

SENSEX

************************************************************************

UPDATE AS ON 30.11.09

WE GOT RESISTED EXACTLY AT UPPER TRENDLINE OF DOWNWARD CHANNEL.

***************************************************************************

UPDATE AS ON 1.12.09

WE HAVE COME OUT FROM DOWNWARD CHANNEL , A BULLISH SIGN

Friday, November 27, 2009

Thursday, November 26, 2009

10000 hits !

blog has crossed 10,000 hits.i recall when i had given title of 5000 hits in 3 months time KPR misunderstood and thought it was call for nifty and see nifty has also crossed 5k mark during this 3 months time.

if u have observed i am having some problem with my system in saving and pasting charts for blog. size gets reduced. so i am not putting charts since few days.very soon i will sort the problem.

market has broken trendline running from 15331 after consuming 1.618% time in recovering 1960 points after a fall of 2162 points.first imp low was arnd 17k and that is gone today.next immediate imp low is at 16636.

fibo lvls r 16542/16311 and 16080 for 38.2/50 and 61.8% of rise of 1960 points.

so better to keep strict stop losses on long positions. new long positions shd be avoided at present for few days.let mkt settle.

one more change i have planned and following also since few days after reading few mails at isg from Spandan and other friends. i had observed that by tracking sensex regularly readers as well as me were getting carried away by observations on sensex and that always affects yr decisions for buying n selling stocks. patterns for stock and sensex may be different.so i have minimised analysis of sensex and i am increasing analysis of stocks.i have started giving stop loss only while analysing stock. for target u have to observe yrself and go on raising yr stop loss as well as target.

for simple analysis better to follow 1-2-3 system. i will discuss this pattern with help of chart in detail in few days .

i thank u all for yr kind support and encouragement!

Wednesday, November 18, 2009

Tuesday, November 17, 2009

Monday, November 16, 2009

SENSEX AT 80% RETRACEMENT LVL 17061

Saturday, November 14, 2009

sensex

**********************************************************

UPDATE ON 16.11.09 AT 11.00 AM

WE R VERY CLOSE TO 80% RETRACEMENT LEVEL 17061 OF FALL FROM 17493 TO 15331. ON CROSSING THIS LEVEL ONLY MKT CAN GO FOR NEW HIGH OTHER WISE WE CAN SEE CORRECTION.

WATCH FROM SIDE LINES FOR SOME TIME AND ACT AS PER FURTHER MOVES

Thursday, November 12, 2009

Wednesday, November 11, 2009

Tuesday, November 10, 2009

MOTHERSON SUMI

look at chart

******************

UPDATE AS ON 16.11.09 12.45 PM

MOTHERSON IS TRADING AT 138.8 AFTER MAKING ATOP OF 143+

BOOK PROFITS

Monday, November 9, 2009

RETRACEMENT OVER?

Saturday, November 7, 2009

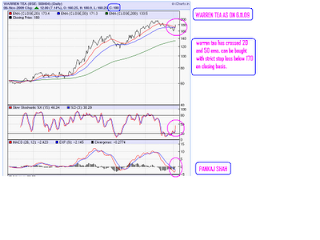

ZANDU PHARMA, MONSANTO, WARREN TEA

**********************

UPDATE ON 27.11.09

WARREN TEA HAS CLOSED TODAY AROUND 220.

CHEERS!

******************************

UPDATE ON 6.1.2010

MONSANTO 1800+

ZANDU HAS GIVEN EMAMI SHARES SO VERY GOOD RETURNS FOR ZANDU SHARE HOLDERS

Wednesday, November 4, 2009

SENSEX

COMMENTS ON CHART

*************************************************************************

UPDATE AS ON 7.11.09

AS PER EXPECTATION WE HAVE SEEN GOOD BOUNCE IN LAST COUPLE OF DAYS. WE HAVE CROSSED 38.2% LEVEL AND AFTER TESTING 16283 WE HAVE CLOSED EXACTLY AT 38.2% LEVEL.PROFIT BOOKING SHD BE DONE IN BUYING DONE AT LOWER LEVELS.

Tuesday, November 3, 2009

SENSEX AS ON 3.11.09

************************************************************************

UPDATE AT 4.50 P.M. ON 4.11.09

CHEERS !

MARKET UP BY MORE THAN 500POINTS AS PER EXPECTED AND SHOWN IN CHART!

WAKE UP BEAR!

we saw reversal from 16/10/09

http://pankaj564.blogspot.com/2009/10/wake-up-bear.html

Saturday, October 31, 2009

BEARS WHO ARE CALLING FOR A MARKET REVERSAL - DREAM ON

Blog: sandip sabharwal

Post: BEARS WHO ARE CALLING FOR A MARKET REVERSAL - DREAM ON

Link: http://sandipsabharwal.blogspot.com/2009/10/bears-who-are-calling-for-market.html

DOW

DOW HAS ALSO CORRECTED HEAVILY IN LAST WEEK AND

****************************************************************

UPDATE ON 3.11.09 6 P.M.

DOW GAVE A STRONG BOUNCE. BUT TODAY ALL MKTS R WEAK. DOW TO FOLLOW WORLD MKTS AND TO TUMBLE AGAIN?

Friday, October 30, 2009

SENSEX WAVE COUNT

*****************************************************************************

UPDATE AT 4.00PM 30/10/2009

WITH HELP OF +VE GLOBAL MKTS WE OPENED UP AND WENT UPTO 16360 AND REVERSED FROM THERE.SO FIRST LVL SHOWN IN CHART OF CLOSE ABOVE 16375 NOT WORKED AND WE HAVE CORRECTED BELOW YESTERDAY'S LOW.SO BULLISH VIEW NOT TO BE CONSIDERED.

MORE OVER TODAY WEEKLY MACD HAS GIVEN SELL SIGNAL. SO BETTER TO SELL ON PULL BACK RALLIES

Thursday, October 29, 2009

5 DAY CHART/+VE DIVERGENCE

5 DAY CHART SHOWING +VE DIVERGENCE IN RSI AND MACD, WE CAN EXPECT BOUNCE FROM TODAY'S LOW LVLS.

***************************************************************************

WE SAW VERY GOOD BOUNCE FROM LOW LEVELS AND WE ALMOST COVERED FROM SUB 16K TO MORE THAN 16250+ BEFORE SELLING AGAIN.

Wednesday, October 28, 2009

MARKET?

***************************************************

UPDATE ON 29.10.09

MARKET TESTED 15994 TODAY AND BOUNCED BACK FROM THERE UPTO 16250 BEFORE SELLING WAS SEEN AGAIN.

AS SHOWN IN CHART IF WE BOUNCE FROM HERE AND UPMOVE IS SEEN THAT WILL BE BULLISH WAVE COUNT SHOWN IN DARK BROWN COLOR IN CHART.

STRICT STOP LOSS FOR BULLISH VIEW CAN BE KEPT AT 15994.

I am an investment counsellor and not a casino owner.

Adding Zeros

The lessons from a low-profile second-generation stockbroker who adds zeros

after his clients wealth, not put them through a zero-sum game

I am amazed when people get excited that a big institutional investor is

buying some stock in a big way. I have seen it in bond markets too. The

dealer will come in and say, Citi is buying, implying that if Citi is a

buyer, there has to be something to it. Nobody will say who the seller is.

Obviously, you cannot buy unless there is a seller. If stocks are worth

buying and everyone thinks so, then why is somebody selling, when all

research analysts think that it is good to buy? We always hear one side of

the story.

We never get to know the other side at all. Maybe it is the domestic trader

who keeps buying and warehousing when the prices are low and, as demand

picks up, he dumps it on an institutional buyer who, in turn, will dump it

on the retail buyer at some point. And the retail buyer, once having bought,

gets stuck. He either becomes a long-term investor or makes a quick exit

(profit or loss borne by him). So, stock markets are a zero-sum game. At

different points in time, different hands hold the parcel. Change in market

prices (which are a function of demand, supply and expectations) increase or

decrease the value of holdings. If you are a short-term trader, you actually

experience the pain or gain. If you are a long-term investor, you only see

changes in your asset value. Of course, you can also get your annual

dividends.

I always wonder at human frailty, when it comes to stock markets. There are

occasions when everyone agrees that, at some point, the markets are very

expensive. How many actually sell? Or how many actually go short on the

market at this stage? Surely, no one does this consistently. At some level,

you sell your shares. Do you again buy them when the market comes off? I

always wonder. No list of names of the worlds rich ever includes any

stock-trader. Warren Buffet has probably never sold much and what his fund

owns are significant chunks of many companies. Bill Gates owes his wealth to

one stockof the company he founded. This leads me to think that

stock-traders are not all that productive in what they do. They are part of

the make-believe world that the media creates for pulling in an audience.

Serious wealth has been perhaps made only by investors who keep hanging on

to their shares and not churn them like a mutual fund manager.

In this context, I recall meeting a stockbroker in Mangalore. He is carrying

on his fathers business and has a loyal clientele. He would advise people to

invest regularly (before systematic investment plan became a buzzword). He

would come out with an annual investment list of around 20 large-cap stocks,

dividing the money equally. He would not churn the portfolio at all, unless

there was a compelling reason to sell any stock. He would do an annual

review and, sometimes, he would add one or two stocks. He preferred to stick

to established names, with high emphasis on management quality and return on

equity. He had kept tabs on what the portfolio did. It generated a

compounded annual return of over 30% over 20 years, excluding dividends. His

churn was less than 5% of the portfolio, over 20 years! This return was

almost twice what the Sensex delivered in the same timeframe.

I quite liked the way he went about his business. Many of his clients were

second-generation clients! He never strayed from his approach. He also

refused to offer his clients any platform for trading in derivatives. His

view was very simple. I am an investment counsellor and not a casino owner.

He also eschewed the small-cap and mid-cap stocks. He said that he did not

have the resources to do homework on them. He did not want me to identify

him, unlike the top brokers who are always seeking to be on television. I

dedicate this column to this low-profile gentleman at Mangalore and wish him

the very best.

Monday, October 26, 2009

ADANI ENT TO DECLARE BONUS AND RIGHT SHARES

*******************************************************************

UPDATE AS ON 9.11.09

ADANI ENT ON FIRE!

IT TRADES ABOVE 950.

CHEERS!

NICE - Speech was delivered to the Class of 2006 at the IIM

This speech was delivered to the Class of 2006 at the Indian Institute of Management, Bangalore on defining success by Subroto Bagchi CEO MindTree.

I was the last child of a small-time government servant, in a family of five brothers. My earliest memory of my father is as that of a District Employment Officer in Koraput, Orissa. It was, and remains as back of beyond as you can imagine. There was no electricity; no primary school nearby and water did not flow out of a tap. As a result, I did not go to school until the age of eight; I was home-schooled. My father used to get transferred every year. The family belongings fit into the back of a jeep – so the family moved from place to place and without any trouble, my Mother would set up an establishment and get us going. Raised by a widow who had come as a refugee from the then East Bengal, she was a matriculate when she married my Father.

My parents set the foundation of my life and the value system, which makes me what I am today and largely, defines what success means to me today.

As District Employment Officer, my father was given a jeep by the government. There was no garage in the Office, so the jeep was parked in our house. My father refused to use it to commute to the office. He told us that the jeep is an expensive resource given by the government- he reiterated to us that it was not "his jeep" but the government's jeep. Insisting that he would use it only to tour the interiors, he would walk to his office on normal days.. He also made sure that we never sat in the government jeep – we could sit in it only when it was stationary.

That was our early childhood lesson in governance – a lesson that corporate managers learn the hard way, some never do.

The driver of the jeep was treated with respect due to any other member of my Father's office. As small children, we were taught not to call him by his name. We had to use the suffix 'dada' whenever we were to refer to him in public or private. When I grew up to own a car and a driver by the name of Raju was appointed – I repeated the lesson to my two small daughters. They have, as a result, grown up to call Raju, 'Raju Uncle' – very different from many of their friends who refer to their family driver, as 'my driver'. When I hear that term from a school- or college-going person, I cringe.

To me, the lesson was significant – you treat small people with more respect than how you treat big people. It is more important to respect your subordinates than your superiors.

Our day used to start with the family huddling around my Mother's chulha – an earthen fire place she would build at each place of posting where she would cook for the family. There was neither gas, nor electrical stoves.The morning routine started with tea. As the brew was served, Father would ask us to read aloud the editorial page of The Statesman's 'muffosil' edition – delivered one day late. We did not understand much of what we were reading. But the ritual was meant for us to know that the world was larger than Koraput district and the English I speak today, despite having studied in an Oriya medium school, has to do with that routine. After reading the newspaper aloud, we were told to fold it neatly. Father taught us a simple lesson.

He used to say, "You should leave your newspaper and your toilet, the way you expect to find it". That lesson was about showing consideration to others. Business begins and ends with that simple precept.

Being small children, we were always enamored with advertisements in the newspaper for transistor radios – we did not have one. We saw other people having radios in their homes and each time there was an advertisement of Philips, Murphy or Bush radios, we would ask Father when we could get one. Each time, my Father would reply that we did not need one because he already had five radios – alluding to his five sons.

We also did not have a house of our own and would occasionally ask Father as to when, like others, we would live in our own house. He would give a similar reply," We do not need a house of our own. I already own five houses". His replies did not gladden our hearts in that instant.

Nonetheless, we learnt that it is important not to measure personal success and sense of well being through material possessions.

Government houses seldom came with fences. Mother and I collected twigs and built a small fence. After lunch, my Mother would never sleep. She would take her kitchen utensils and with those she and I would dig the rocky, white ant infested surrounding. We planted flowering bushes. The white ants destroyed them. My mother brought ash from her chulha and mixed it in the earth and we planted the seedlings all over again. This time, they bloomed. At that time, my father's transfer order came. A few neighbors told my mother why she was taking so much pain to beautify a government house, why she was planting seeds that would only benefit the next occupant. My mother replied that it did not matter to her that she would not see the flowers in full bloom. She said, "I have to create a bloom in a desert and whenever I am given a new place, I must leave it more beautiful than what I had inherited".

That was my first lesson in success. It is not about what you create for yourself, it is what you leave behind that defines success.

My mother began and galvanized the nation in to patriotic fervor. Other than reading out the newspaper to my mother, I had no clue about how I could be part of the action. So, after reading her the newspaper, every day I would land up near the University's water tank, which served the community. I would spend hours under it, imagining that there could be spies who would come to poison the water and I had to watch for them. I would daydream about catching one and how the next day, I would be featured in the newspaper. Unfortunately for me, the spies at war ignored the sleepy town of Bhubaneswar and I never got a chance to catch one in action. Yet, that act unlocked my imagination.

Imagination is everything. If we can imagine a future, we can create it, if we can create that future, others will live in it. That is the essence of success.

Over the next few years, my mother's eyesight dimmed but in me she created a larger vision, a vision with which I continue to see the world and, I sense, through my eyes, she was seeing too. As the next few years unfolded, her vision deteriorated and she was operated for cataract. I remember, when she returned after her operation and she saw my face clearly for the first time, she was astonished. She said, "Oh my God, I did not know you were so fair".. I remain mighty pleased with that adulation even till date. Within weeks of getting her sight back, she developed a corneal ulcer and, overnight, became blind in both eyes. That was 1969. She died in 2002. In all those 32 years of living with blindness, she never complained about her fate even once. Curious to know what she saw with blind eyes, I asked her once if she sees darkness. She replied, "No, I do not see darkness. I only see light even with my eyes closed". Until she was eighty years of age, she did her morning yoga everyday, swept her own room and washed her own clothes.

To me, success is about the sense of independence; it is about not seeing the world but seeing the light.

Over the many intervening years, I grew up, studied, joined the industry and began to carve my life's own journey. I began my life as a clerk in a government office, went on to become a Management Trainee with the DCM group and eventually found my life's calling with the IT industry when fourth generation computers came to India in 1981. Life took me places – I worked with outstanding people, challenging assignments and traveled all over the world.

In 1992, while I was posted in the US, I learnt that my father, living a retired life with my eldest brother, had suffered a third degree burn injury and was admitted in the Safderjung Hospital in Delhi. I flew back to attend to him – he remained for a few days in critical stage, bandaged from neck to toe. The Safderjung Hospital is a cockroach infested, dirty, inhuman place. The overworked, under-resourced sisters in the burn ward are both victims and perpetrators of dehumanized life at its worst. One morning, while attending to my Father, I realized that the blood bottle was empty and fearing that air would go into his vein, I asked the attending nurse to change it. She bluntly told me to do it myself. In that horrible theater of death, I was in pain and frustration and anger. Finally when she relented and came, my Father opened his eyes and murmured to her, "Why have you not gone home yet?" Here was a man on his deathbed but more concerned about the overworked nurse than his own state. I was stunned at his stoic self.

There I learnt that there is no limit to how concerned you can be for another human being and what the limit of inclusion is you can create.

My father died the next day. He was a man whose success was defined by his principles, his frugality, his universalism and his sense of inclusion.

Above all, he taught me that success is your ability to rise above your discomfort, whatever may be your current state. You can, if you want, raise your consciousness above your immediate surroundings. Success is not about building material comforts – the transistor that he never could buy or the house that he never owned. His success was about the legacy he left, the memetic continuity of his ideals that grew beyond the smallness of a ill-paid, unrecognized government servant's world.

My father was a fervent believer in the British Raj. He sincerely doubted the capability of the post-independence Indian political parties to govern the country. To him, the lowering of the Union Jack was a sad event. My Mother was the exact opposite. When Subhash Bose quit the Indian National Congress and came to Dacca, my mother, then a schoolgirl, garlanded him. She learnt to spin khadi and joined an underground movement that trained her in using daggers and swords. Consequently, our household saw diversity in the political outlook of the two. On major issues concerning the world, the Old Man and the Old Lady had differing opinions.

In them, we learnt the power of disagreements, of dialogue and the essence of living with diversity in thinking.

Success is not about the ability to create a definitive dogmatic end state; it is about the unfolding of thought processes, of dialogue and continuum.

Two years back, at the age of eighty-two, Mother had a paralytic stroke and was lying in a government hospital in Bhubaneswar. I flew down from the US where I was serving my second stint, to see her. I spent two weeks with her in the hospital as she remained in a paralytic state. She was neither getting better nor moving on. Eventually I had to return to work. While leaving her behind, I kissed her face. In that paralytic state and a garbled voice, she said,

"Why are you kissing me, go kiss the world." Her river was nearing its journey, at the confluence of life and death, this woman who came to India as a refugee, raised by a widowed Mother, no more educated than high school, married to an anonymous government servant whose last salary was Rupees Three Hundred, robbed of her eyesight by fate and crowned by adversity was telling me to go and kiss the world!

Success to me is about Vision. It is the ability to rise above the immediacy of pain. It is about imagination. It is about sensitivity to small people. It is about building inclusion. It is about connectedness to a larger world existence. It is about personal tenacity. It is about giving back more to life than you take out of it. It is about creating extra-ordinary success with ordinary lives.

Thank you very much; I wish you good luck and God's speed. Go! kiss the world.

Saturday, October 24, 2009

Friday, October 23, 2009

Wednesday, October 21, 2009

SENSEX AS ON 21.10.09

***************************************************************************

UPDATE AT 4.13 P.M.

WE HAVE BROKEN TRENDLINE RUNNING FROM MARCH LOWS AND WE SAW SELL OFF. TODAY'S LOW AT 16721 IS ON PURPLE TRENDLINE I HAD SHOWN IN CHART AND WE HAVE TAKEN SUPPORT THERE.IT IS UPPER TRENDLINE OF TRIANGLE CONSOLIDATION.WE MAY SEE A SMALL BOUNCE FROM HERE WHICH CAN BE USED FOR SELLING.